SSE provides energy needed today while building a better world of energy for tomorrow.

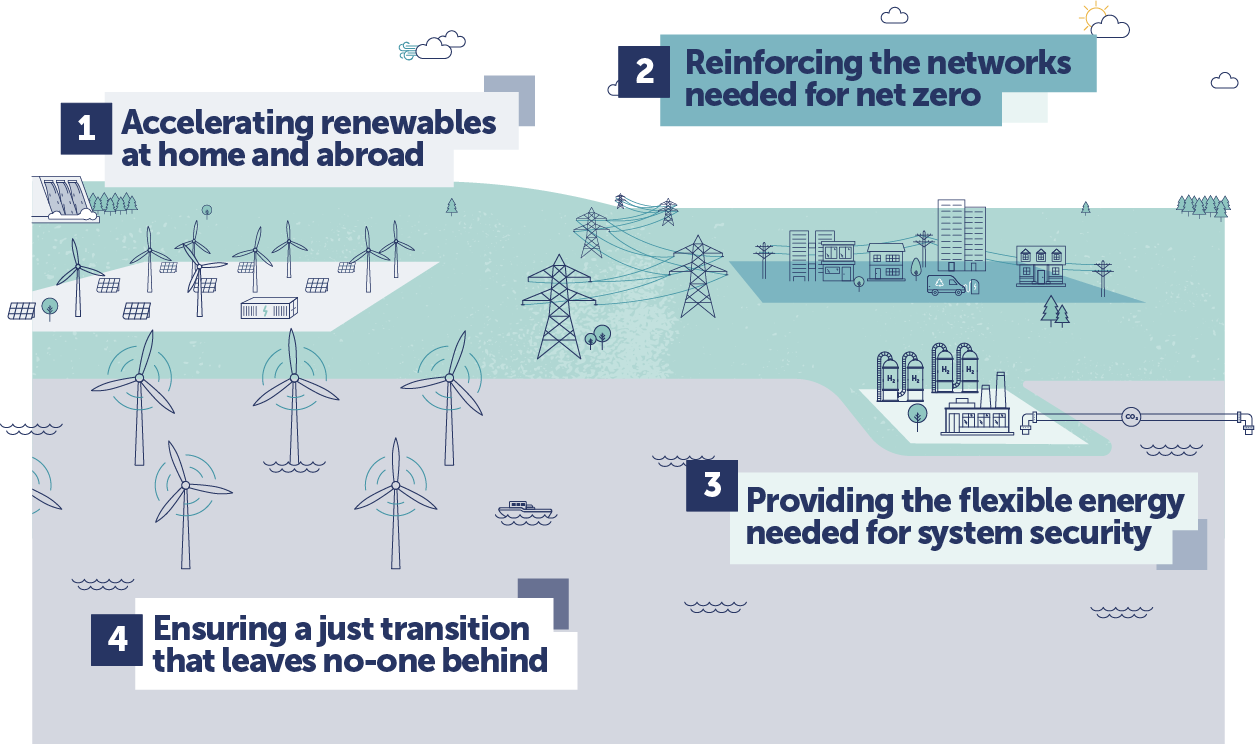

Our strategy is to create value for shareholders and society in a sustainable way by developing, building, operating and investing in the electricity infrastructure and businesses needed in the transition to net zero.

SSE Renewables

Market BasedFrom onshore wind, offshore wind and hydroelectric to solar and battery storage, SSE Renewables is a world class developer and operator of renewable energy in the UK and Ireland with a growing presence internationally.

2022/23 operating profit

£580.0m

Adjusted

£446.3m

Reported

2022/23 Operating profit contribution to Group

23%

2022/23 Proportion of Group capex

39%

SSE Thermal

Market BasedFlexible thermal generation and gas storage supports the net zero transition by providing efficient gas power for when the wind doesn’t blow and sun doesn’t shine. Looking forwards, SSE Thermal’s focus is on decarbonising generation through emerging carbon capture and hydrogen technology.

2022/23 operating profit

£1,031.9m

Adjusted

£1,089.5m

Reported

2022/23 Operating profit contribution to Group

41%

2022/23 Proportion of Group capex

7%

SSEN Transmission

Economically regulatedSSEN Transmission operates the high voltage electricity transmission network across the north of Scotland, including the Scottish islands. It transports gigawatts of clean, green renewable power from where is generated to demand centres further South.

2022/23 operating profit

£372.7m

Adjusted

£405.5m

Reported

Operating profit contribution to Group

15%

2022/23 Proportion of Group capex

23%

SSEN Distribution

Economically regulatedSSEN Distribution transports power to the doorstep of 4 million homes and businesses across the north of Scotland and central southern England. It’s at the heart of developing the flexible distribution network needed for a low-carbon world.

2022/23 operating profit

£382.4m

Adjusted

£382.4m

Reported

Operating profit contribution to Group

15%

2022/23 Proportion of Group capex

19%

Energy Solutions

Market basedSSE Business Energy in Great Britain and SSE Airtricity on the island of Ireland provide a shopfront and route to market for SSE’s generation, renewable green products and low-carbon energy solutions.

SSE Airtricity 2022/23 operating profit

£5.6m

Adjusted

£5.2m

Reported

SSE Business Energy 2022/23 operating profit

£17.9m

Adjusted

£17.9m

Reported

Our Business Model

We aim to be a leading energy company in a net zero world.

SSE’s highly-deliberate business model is aligned with the broad political and societal consensus on legally-binding net zero carbon emissions targets in the UK.

Develop

SSE identifies opportunities where it can best use its capability in providing the clean, affordable energy infrastructure needed to decarbonise the economy.

Build

SSE consistently delivers highly complex electricity infrastructure in a timely manner and within budget.

Operate

SSE operates its assets in a responsive and responsible way. It promotes a culture of continuous improvement and stakeholder engagement to provide quality customer service.

Invest

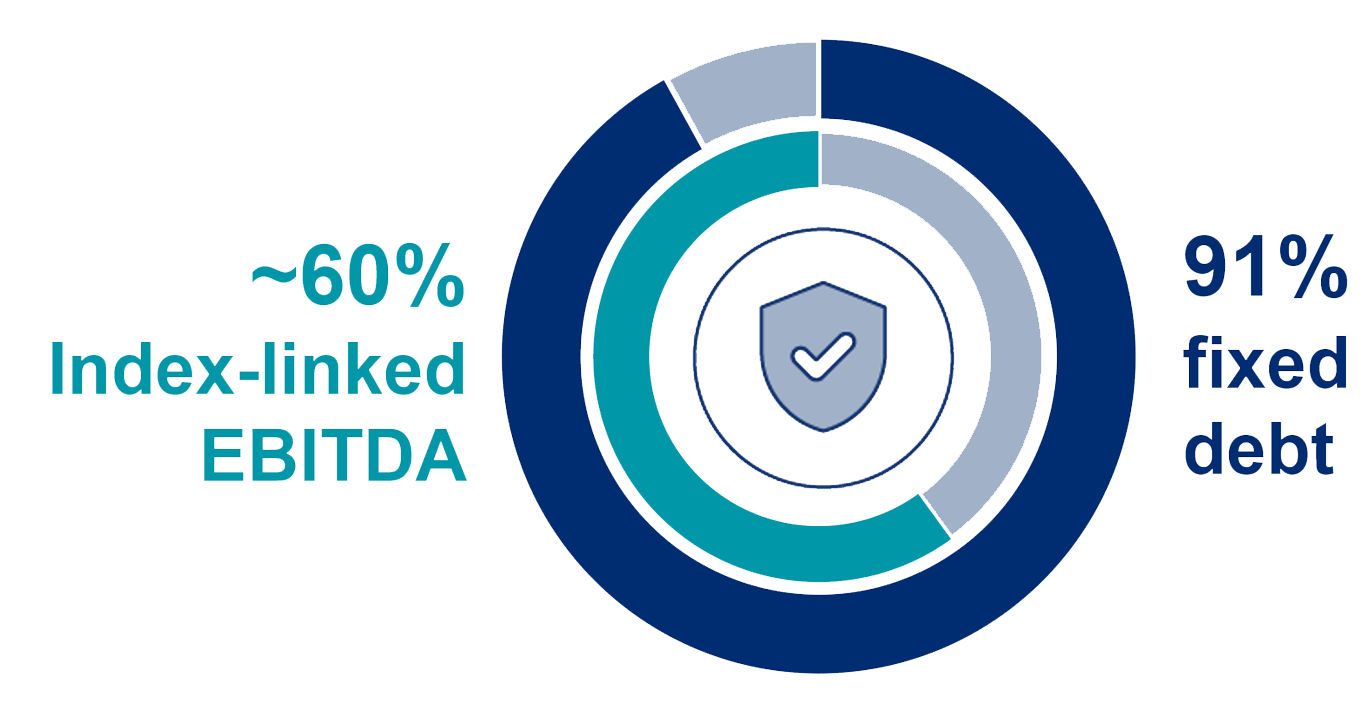

SSE invests in low-carbon infrastructure as part of its net zero-focused strategy. Its investments are fully funded and underpinned by partnering which unlocks value, and debt secured at efficient rates.

Key

Click segments to learn moreNZAP PLUS

SSE’s Net Zero Acceleration Programme (NZAP) Plus is a 5 year, fully-funded, £20.5bn investment plan to 2027. Tap segments to learn moreKey targets

Five year EPS CAGR

*from 2021/22 94.8p

Our latest financial results and strategy presentation

DownloadSell Side Analysts

Our analyst listWith a strong track record of navigating volatility

Dividend policy aligned with accelerated growth profile

DPS to be rebased in FY24

Our Shareholder Services

Our latest Annual Report