A year of unprecedented volatility...

...in the global energy markets has cemented the role that SSE and other energy providers must play in providing long-term solutions to the challenges of national energy security, affordability and climate change.

Raising the bar on net zero

The first full year of SSE’s Net Zero Acceleration Programme will be remembered as a period of strategic gains and financial and operational progress in a shifting and uncertain energy landscape.

Click to play

“Backed by excellent growth options and strong financial performance, we are well placed to explore further investments to support an accelerated transition to net zero with the ‘NZAP Plus’ we announced in May 2023.”

Alistair Phillips-Davies, Chief Executive, SSE plc

Financial highlights

In the face of exceptional macro-economic conditions, SSE saw strong financial performance in 2022/23 thanks to its resilient business model, solid operational delivery and good progress on its strategy. Below-plan renewables output was offset in the year by thermal, flexible hydro and gas storage assets which were rewarded for providing timely system backup.

Group operating profit/loss

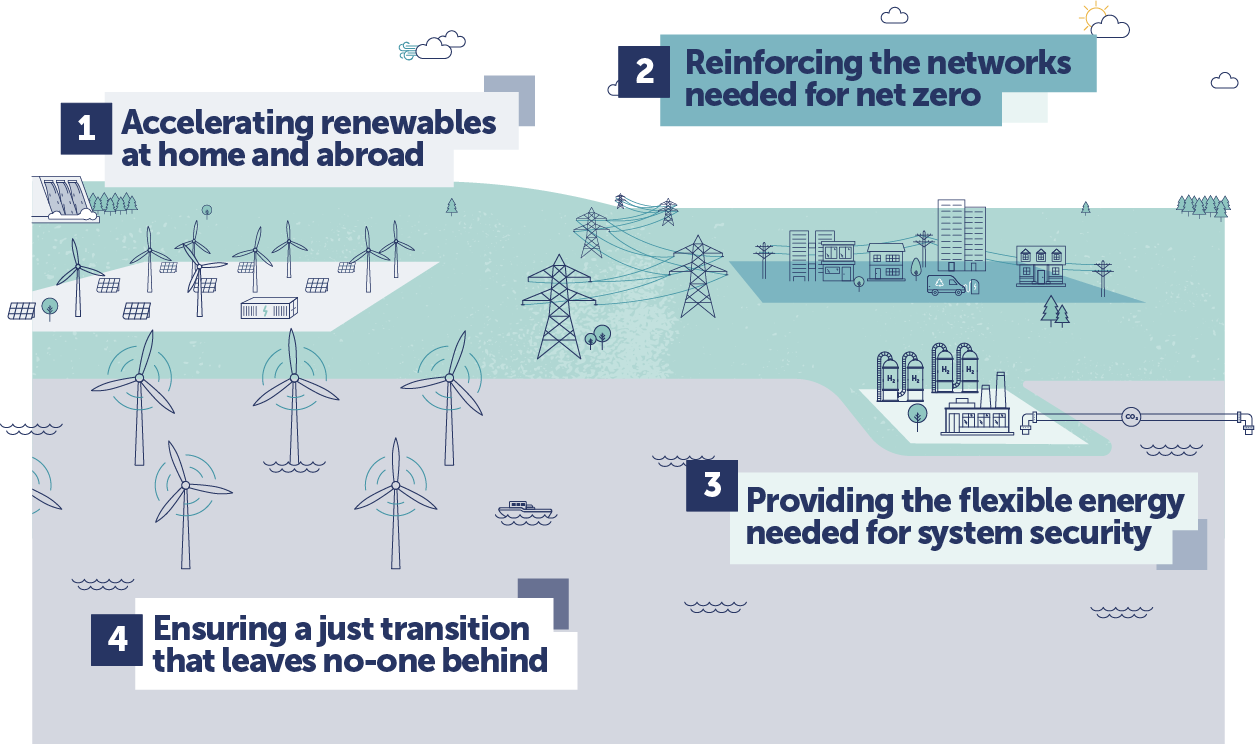

SSE's place in the future energy world

Together, as a Group, SSE’s businesses are well positioned to capture the substantial growth opportunities generated by driving and accelerating the net zero agenda through electricity infrastructure.

SSE Renewables

Market BasedOnshore and offshore wind; flexible, run-of-river and pumped storage hydro; solar and battery.

Operating profit

£580.0m

Adjusted

£446.3m

Reported

Operating profit contribution to Group

23%

Proportion of Group capex

39%

SSE Thermal

Market BasedGas-fired power stations; hydrogen carbon capture and storage; gas storage.

Operating profit

£1,031.9m

Adjusted

£1,089.5m

Reported

Operating profit contribution to Group

41%

Proportion of Group capex

7%

SSEN Transmission

Economically regulatedConnecting power generation to urban areas of demand.

Operating profit

£372.7m

Adjusted

£405.5m

Reported

Operating profit contribution to Group

15%

Proportion of Group capex

23%

SSEN Distribution

Economically regulatedPowering 3.9m homes and businesses.

Operating profit

£382.4m

Adjusted

£382.4m

Reported

Operating profit contribution to Group

15%

Proportion of Group capex

19%

Energy Solutions

Market basedProviding access to green energy for households and businesses.

SSE Airtricity operating profit

£5.6m

Adjusted

£5.2m

Reported

SSE Business Energy operating profit

£17.9m

Adjusted

£17.9m

Reported

NZAP Plus: An optimal pathway to growth

SSE made clear that the Net Zero Acceleration Programme (NZAP) it launched in November 2021 was a floor, not a ceiling to its ambitions. NZAP Plus is a platform to maximise stakeholder value into the 2030s.

- 2023

- 2027

- 2030

- 2040

- 2023

In May 2023, 18 months on from its initial launch, the NZAP was revised to reflect SSE’s increasing investment and earnings, and the wealth of opportunities created as the world pursues net zero.

- 2027

The new NZAP Plus includes investment of £18bn over the five years to 2027 and a balanced allocation of investment across the Group.

The added investment means SSE’s total capital expenditure equates to around £10m a day spent on critical national infrastructure. The plan also features revised growth targets to 2027 for SSE Renewables, SSEN Transmission and SSEN Distribution.

- 2030

The NZAP Plus means more value for shareholders and society, more financial strength, more investment, more jobs, and more growth to come over the next decade.

- 2040

SSE has a Board-approved target to achieve net zero emissions across scope 1 and 2 emissions by 2040 at the latest and for remaining scope 3 emissions by 2050 at the latest.

Key

Click segments to learn moreReallocation of a new fully-funded £18bn investment plan

This equates to £10m a day spent on national infrastructure. Tap segments to learn more

Our medium-term goals: Renewables

>9GW

net capacity

>15GW

in pipeline

Our medium-term goals: Electricity networks

~14%

Gross RAV CAGR

A year of strategic progress

Ensuring a just transition

"A truly just transition to net zero will leave no-one behind and that means bringing our stakeholders with us.

"SSE was an early adopter of the principles of a just transition and we recognise that continued consensus in favour of net zero will, in part, depend on the fairness, perceived and experienced, of the way in which the costs and benefits of climate action are distributed."

Sir John Manzoni, Chair, SSE plc